It has a competitive intro APR offer on purchases and balance transfers, in addition to not charging a penalty APR for a late or missed payment.

People who want to finance a large purchase or who need a fairly low-cost card to help pay down a transferred balance. If you want a shot at earning rewards while still benefiting from an intro APR offer, the Bank of America Customized Cash Rewards offers a similar intro APR offer on balance transfers, while also touting a rewards program that gives you the power to pick your highest-earning spend category.

Learn more: U. Bank Visa Platinum benefits guide. Read our full U. Bank Visa Platinum review. Best for travel rewards. This rewards card offers competitive earning rates on popular spending categories, including travel, in addition to a competitive intro APR offer and a generous welcome offer.

Anyone who wants the chance to earn bonus category rewards and have the opportunity to finance a purchase or complete a balance transfer with an intro APR offer. The Discover it® Balance Transfer offers an even more competitive intro APR offer on balance transfers and a similar rewards program.

Learn more: Is the Chase Freedom Flex worth it? Read our full Chase Freedom Flex review. When evaluating the best balance transfer and low-interest cards, we consider a mix of factors, including how cards score in our proprietary card rating system and whether cards offer features that fit the priorities of a diverse group of cardholders.

This includes users who need to carry a balance long term, need as much time as possible to chip away at debt or are looking for maximum long-term value via rewards. This includes both the introductory rate itself and the length of the intro APR on both balance transfers and new purchases.

For cards designed primarily for balance transfers, the intro APR offer on balance transfers has the largest impact on overall score.

For general low-interest cards, the intro APR offer on new purchases has the largest impact on overall score, followed by the ongoing APR and intro APR offer on balance transfers. This weighting assumes cardholders considering a card in this category will prioritize payment flexibility on new purchases or may need to carry a balance long term, whereas cardholders trying to pay off debt will opt for a dedicated balance transfer card.

While this fee carries less weight when we assess general low-interest cards than dedicated balance transfer cards, it still factors into our evaluation since cardholders may decide to transfer debt to a low-interest card even if it offers no intro APR or an intro APR higher than 0 percent.

This is because many users prioritize getting as much time as possible to pay off debt while avoiding interest. Other fees considered in our assessment include the presence of annual, foreign transaction, cash advance and late payment fees, along with penalty APRs.

While getting a generous intro APR offer and low ongoing APR are likely to be the biggest priorities for someone looking for a low-interest or balance transfer card, we also consider how much value a card can offer after its intro APR comes to an end. Balance transfer and low-interest cards receive a higher rating and are more likely to be included in our list of best cards if they also include an ongoing rewards program or unique and valuable perks.

With this in mind, our best cards list often includes a number of rewards and cash back cards alongside dedicated balance transfer cards. These cards tend to offer slightly shorter intro APR periods, but could help you save more overall, either via rewards earned on everyday spending, valuable perks or a lower balance transfer fee.

Have more questions for our credit cards editors? Feel free to send us an email , find us on Facebook , or Tweet us Bankrate. A balance transfer credit card is a tool people can use to help pay off debt. This interest-free period allows you to pay off the principal balance without interest charges adding to your debt.

A balance transfer is the process of moving a balance from one credit card to another. In some cases, you can transfer more than just credit card balances to a balance transfer card.

When the intro APR period ends, interest applies to any remaining balance at the end of each billing cycle like a regular credit card. The average intro APR period is 12 to 21 months, with many of the best balance transfer intro periods offering 18 to 21 months. Plenty of things make a balance transfer card worthwhile, but some of the drawbacks may have you eyeing other options.

Consider the following pros and cons when taking a look at a balance transfer credit card. Save money : You could save on interest charges by temporarily pausing interest on transferred debt.

Reduce monthly payments : The temporary break from interest on your transferred balance could translate to a lower monthly payment during the intro APR period. Consolidate debts : If you have multiple cards with high balances, you can simplify your debt payment process by consolidating the debt onto one card.

High credit approval threshold : The best balance transfer cards with the longest 0 percent intro offers tend to be available to people with good or excellent credit. What happens if you reach the end of a balance transfer intro offer and still have a balance?

Bankrate's experts break down your options for lingering credit card debt. A 0 percent intro APR offer could save you several hundred dollars or more if you're paying down a large balance. The chart below highlights some of our top balance transfer cards and demonstrates potential savings with each one.

Want to try it out? To help guide you on choosing a balance transfer credit card that fits your unique financial situation, consider the following questions:.

A good balance transfer card will let you make transfers within a generous window of time after the opening of your account. Some common balance transfer windows are 60, 90 or days. Consider this timeframe when choosing your card and make sure you transfer your balance on time. The difference between a 3 percent balance transfer fee and a 5 percent balance transfer fee could be significant, depending on the amount you transfer.

If you want to save money, take a closer look at cards with 3 percent balance transfer fees. If the amount you transfer is relatively small, a 5 percent balance transfer fee may still be a reasonable option. Not all balance transfer cards provide an intro APR offer for new purchases.

Keep this in mind if you plan to use the card for new purchases and a balance transfer. In that case, you may want to consider a card that has an intro APR offer for both balance transfers and new purchases. The best balance transfer cards offer a 0 percent intro APR on transfers for 18 to 21 months.

Interest rates vary widely and knowing exactly what you're signing up for is helpful if you need to occasionally carry a balance beyond the intro period. Most balance transfer cards trade top-notch card features for a lengthy intro APR period. Some may offer general benefits like purchase protection and identity theft protection services, but a few of the best also earn rewards or provide additional discounts or savings on purchases.

When Bankrate editor Ashley Parks chose a balance transfer card to help her pay off debt, she prioritized certain card details over others. I chose the BankAmericard credit card for a couple key reasons.

This detail was important to me since I needed the extra discipline that came with eliminating the possibility to earn rewards. Second, I also wanted the longest intro APR offer I could get because I felt most comfortable having a long payoff timeline just in case something came up to disrupt my plan.

One thing I wish I had given more thought to when I was choosing a balance transfer card is the transfer window. There came a time when I would have liked to transfer another balance to my BankAmericard, but since the day transfer window had passed, I was out of luck. Additionally, one Bankrate survey found that 49 percent of cardholders carry a balance month-to-month.

The longer you carry a balance on a card with a high interest rate, the faster your credit card balance can snowball into debt. As rates remain high, completing a balance transfer could be one of the most helpful ways to manage your debt and save as much as you can on interest charges.

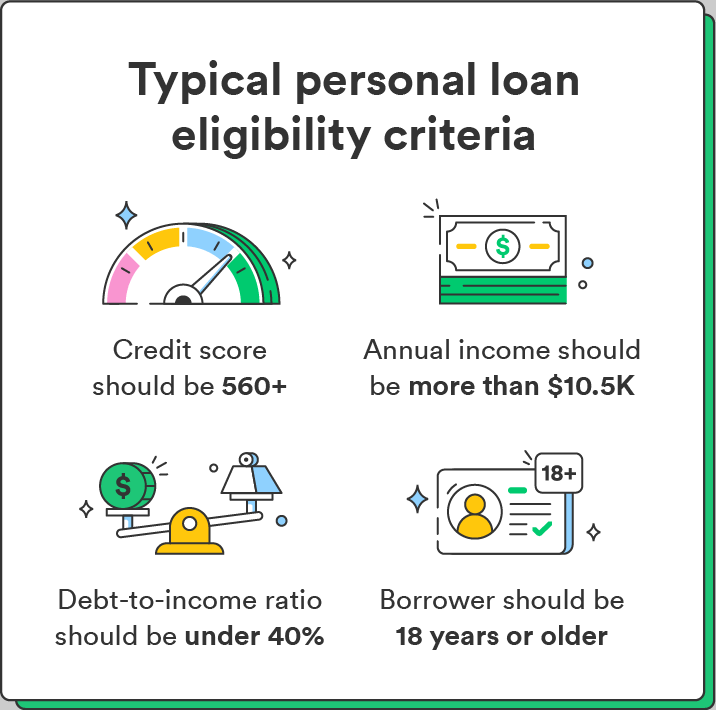

Some of the best balance transfer cards require good to excellent credit FICO score of — to qualify. Even more, last year, credit lenders reported tightening their approval standards , meaning it may be more difficult to qualify for a certain card now. If your credit isn't up to par yet, you may be able to find secured credit cards that allow balance transfers, but they probably won't have 0 percent intro APR offers.

Currently, the Wells Fargo Reflect, Citi Diamond Preferred and Citi Simplicity cards offer some of the longest intro APR periods. Although any temporary break from credit card APR is beneficial, a longer intro offer will give you the best opportunity to pay off your transferred balance.

A few factors could cause you to experience a temporary dip in your credit score after you complete a balance transfer. Applying for a new credit card usually involves a hard inquiry, and opening a new card shortens your average account age.

Also, if you apply for many new accounts in a short time or close an account as soon as you transfer a balance, these actions could negatively affect your score.

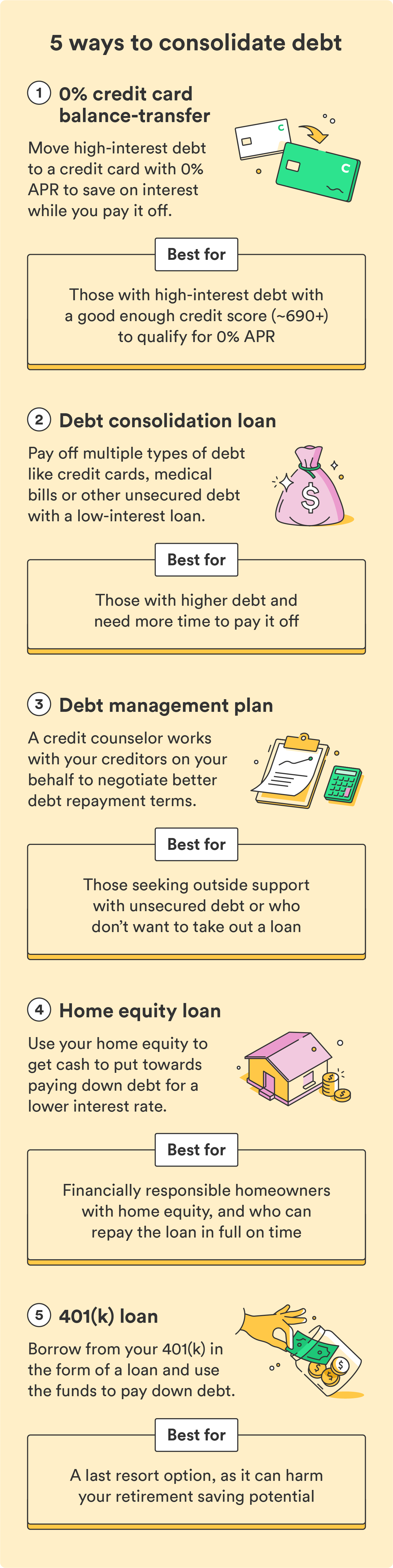

However, your credit score won't be as affected if you pay down the balance on time every month and keep your debt-to-credit ratio low overall. Transferring a credit card balance to a balance transfer card is one of the best ways to pay off debt and save money, but you have other options, too.

Here are a few alternatives to consider:. The amount of time it takes for a balance to transfer from one credit card to another will vary by issuer. The process typically takes five to seven days, but some credit card companies may take up to six weeks to complete balance transfers.

Others may take as little as two days. You will typically receive an estimated turnaround time from your card provider in advance. Also, if your new card issuer approves your balance transfer request, it must coordinate the transfer with your current card issuer, which could cause potential delays.

Your transfer limit is usually equal to or less than your credit limit. However, your credit limit and the balance transfer policies of your specific issuer will determine the amount you can transfer.

Read more : What is the limit for a balance transfer card? As a credit counselor, there are two big mistakes I see people make with balance transfers. First, they transfer the balance and then only make the minimum payment. As a result, when the promotional rate ends they are stuck with a high interest rate again and they often cycle from one balance transfer to the next, paying a fee each time and often not making any real progress on paying down the balance.

Secondly, much like when taking out a debt consolidation loan, people often transfer the balance and then either continue to accrue debt on the previous account or put new charges on the balance transfer account, resulting in more debt and a high interest rate paid on those new charges.

Balance transfer cards can save people who have expensive, overwhelming debt so much money on interest fees. But you have to consider your overall financial picture and commit to paying the transferred balance off and not adding new debt.

By far the biggest mistake people make is running up a balance on the old card again. To make balance transfer credit cards work in your favor, you absolutely have to be committed to the process.

We use primary sources to support our work. Horymski C. Accessed on Jan. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Apply for a credit card with confidence. When you find your odds, you get:. A personalized list of cards ranked by likelihood of approval.

No credit hits. Your personal information and data are protected with bit encryption. That means:. All of your personal information is protected with bit encryption. Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile. Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio DTI which is your monthly debt payments divided by your pre-tax monthly income. Why does DTI matter? We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by bit encryption. A soft credit pull will not affect your credit score.

Last step! Once you enter your email and agree to terms:. Your approval odds will be calculated. A personalized list of cards ranked by order of approval will appear. Your odds will display on each card tile. Enter your email address to activate your approval odds and get updates about future card offers.

You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results. You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer.

To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less. This often happens when the information that's provided is incorrect.

Please try entering your full information again to view your approval odds. Before you apply You get:. Access to special card offers from top issuers in our network.

You can check out other cards that are a better fit. Credit Cards Balance Transfer Advertiser Disclosure Advertiser Disclosure Bankrate.

Ashley Parks. Written by Ashley Parks Arrow Right Editor, Credit cards. Courtney Mihocik. Edited by Courtney Mihocik Arrow Right Senior Editor, Credit Cards.

Ted Rossman. Reviewed by Ted Rossman Arrow Right Senior Industry Analyst, Credit cards. Credit Card Search View card list Menu List Table of contents Why choose Bankrate Caret Down User We helped over , users compare balance transfer cards in Circle Check We compared over introductory APRs.

Lightbulb Over 47 years of experience helping people make smart financial decisions. The Bankrate Promise.

User We helped over , users compare balance transfer cards in Why choose Bankrate The Bankrate Promise. The Bankrate Promise At Bankrate we strive to help you make smarter financial decisions.

View card list Collapse Caret Up. Table of contents Collapse Caret Up. Increase your odds of finding the perfect card. Increase your odds of finding the perfect card 1 in 3 people w ho try approval odds find a card they like. See your approval odds.

Best for no late fee. Citi Simplicity® Card Citi Simplicity® Card. Rating: 4. Bankrate review. appOddsOn { aoProduct. Apply now Lock. Apply now Lock on Citi's secure site. Balance transfer intro APR. Regular APR. Annual fee. Read our full Citi Simplicity review Pros The card does not charge a late fee for missed payments, though they can still hurt your credit score.

Cons There is no rewards program or welcome bonus associated with this card. No Late Fees, No Penalty Rate, and No Annual Fee After that the variable APR will be Balance transfers must be completed within 4 months of account opening.

Stay protected with Citi® Quick Lock. Citi® Diamond Preferred® Card Citi® Diamond Preferred® Card. Pros This card offers a fairly long intro APR period on purchases and balance transfers.

There is no annual fee, which is a plus when looking to focus on paying down transferred balances. This card charges a penalty APR of up to With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

No Annual Fee - our low intro rates and all the benefits don't come with a yearly charge. Wells Fargo Reflect® Card Wells Fargo Reflect® Card. Apply now Lock on Wells Fargo's secure site. Pros The lengthy introductory APR extends to purchases and qualified balance transfers.

Cons The card comes with a 3 percent foreign transaction fee, which is standard, but adds to your balance if you use the card abroad. The card has limited long-term value due to its lack of a traditional rewards program. Select "Apply Now" to take advantage of this specific offer and learn more about product features, terms and conditions.

Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants. It's an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card.

BEST FOR EVERYDAY SPENDING. Blue Cash Everyday® Card from American Express Blue Cash Everyday® Card from American Express. Apply now Lock on American Express's secure site. This card adds boosted rewards for online retail shopping, an uncommon cash back category. supermarket bonus category. It has a 2.

No Annual Fee. Balance Transfer is back! After that, Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon. com checkout. Enrollment required. Terms Apply. Best for 2 percent cash rewards.

Wells Fargo Active Cash® Card Wells Fargo Active Cash® Card. Pros You can earn 2 percent unlimited cash rewards on purchases with this card, a high rate compared to most balance transfer cards. Cons There are balance transfer cards that offer a longer window on their introductory APR offers.

No categories to track or remember and cash rewards don't expire as long as your account remains open. Discover it® Balance Transfer Discover it® Balance Transfer.

Apply now Lock on Discover's secure site. The Unlimited CashBack Match intro offer, which matches your cash back at the end of the first year, stands out among balance transfer cards.

Cons There are a few cards that offer longer introductory APRs on balance transfers. The rewards program is a bit complex and could prove distracting for people who prefer to focus on paying down debts. Redeem your rewards for cash at any time. Your account may not always be eligible for balance transfers.

Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data.

No annual fee. Terms and conditions apply. Citi Double Cash® Card Citi Double Cash® Card. Pros The potential cash back rate on this card is one of the highest for a flat-rate cash back card. This card does not charge an annual fee, saving cardholders a bit more each year.

Cons The intro APR on this card only covers balance transfers, not new purchases, and will not be helpful with financing large purchases. After that, the variable APR will be Balance Transfers do not earn cash back.

Intro APR does not apply to purchases. If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance including balance transfers by the due date each month.

Bank of America® Customized Cash Rewards credit card Bank of America® Customized Cash Rewards credit card. Apply now Lock on Bank of America's secure site. You have the unique opportunity to change your 3 percent spending category once a month.

That means you could earn 3. Contactless Cards - The security of a chip card, with the convenience of a tap. This online only offer may not be available if you leave this page or if you visit a Bank of America financial center.

You can take advantage of this offer when you apply now. BEST FOR GROCERIES. Blue Cash Preferred® Card from American Express Blue Cash Preferred® Card from American Express.

Pros The ongoing annual fee after the first year is easy to offset with cash back and annual credits. Cons Not ideal for spending abroad due to its 2.

The annual spending cap on U. supermarkets could limit its earning potential. Plans created after that will have a monthly plan fee up to 1.

After that, your APR will be a variable APR of Variable APRs will not exceed gas stations. com with your Blue Cash Preferred® Card. Citi Custom Cash® Card Citi Custom Cash® Card. Pros There are intro APR offers on both balance transfers and purchases with this card.

This card carries some unique perks like cell phone protection and a complimentary 3-month DashPass subscription. Cons This card does charge a foreign transaction fee when you spend abroad. No rotating bonus categories to sign up for — as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

No Annual Fee Citi will only issue one Citi Custom Cash® Card account per person. Bank of America® Unlimited Cash Rewards credit card Bank of America® Unlimited Cash Rewards credit card. Rating: 3. Cons This card charges a foreign transaction fee on purchases made outside of the U.

Earn unlimited 1. That means you could earn 1. USAA Rate Advantage Credit Card USAA Rate Advantage Credit Card. Rating: 3 stars out of 5. Apply now Lock on USAA's secure site. Cons Eligibility for the card is restricted to USAA members, which includes military personnel, veterans, and their families.

Must be a USAA member, or become a member, to apply. USAA proudly offers membership to current and former military, as well as their spouses and dependents. After this time, the variable regular APR of Take advantage of USAA's lower interest rate card, whether you're making a purchase or transferring a balance.

Pay less in interest if you carry a balance from month to month. Enjoy the same low variable regular APR on purchases, balance transfers, and cash advances.

No foreign transaction fees. See Rates and Fees for details. Bank of America® Travel Rewards credit card Bank of America® Travel Rewards credit card. Pros The intro APR offer also includes purchases, making it an effective tool for financing purchases.

You can boost your rewards rate by 25 percent to 75 percent as a Bank of America Preferred Rewards® member. Its cardholder perks and benefits are sparse compared to other travel cards. Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout. That means instead of earning an unlimited 1. BEST FOR INTRO APR WITH LOW ONGOING APR.

Cons The card is light on perks and benefits, which limits its long-term value. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Advertiser Disclosure. The pros of balance transfers include : Transferring an existing credit card balance to a card with a lower APR can reduce the amount of interest you pay. Paying less interest could make it easier to pay off your debts in full more quickly.

If you consolidate more than one balance onto a balance transfer card, having one monthly payment can be simpler than paying multiple credit cards- a benefit especially if you've struggled to remember to make on-time payments in the past.

The cons of balance transfers include : A high transfer fee could outweigh the benefits you might get from a lowered APR. If you fail to pay off the entire transfer amount by the end of the promotional period, your APR will reset to a higher rate—one that could potentially be higher than you were paying before making the transfer.

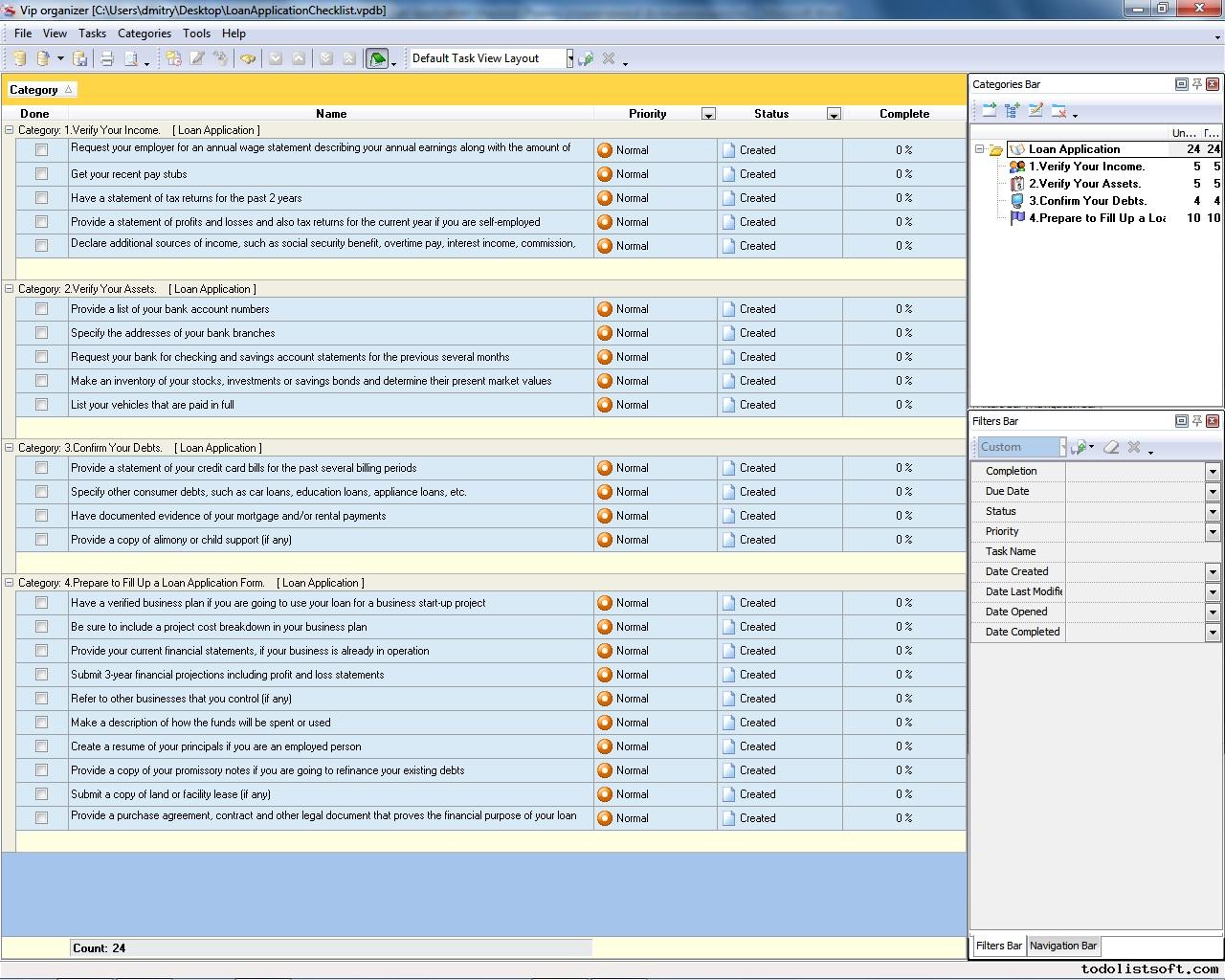

If you continue to use the paid-off card, you could accrue even more debt. Understanding Balance Transfer Fees Balance transfer fees vary depending on the credit card and agreement terms. How To Make a Balance Transfer Keep in mind that you can only transfer up to the credit limit on the new balance transfer credit card you get.

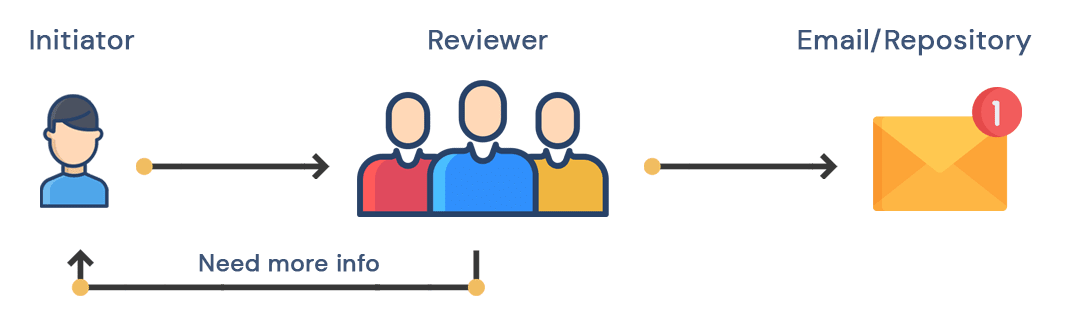

Some additional things to note when completing a balance transfer: When you do respond to a balance transfer credit card offer, you'll fill out additional information—including what amount you want to transfer—and will need to provide account information for the existing card s in order to transfer the balance to your new credit card.

Once the credit card issuer for your new credit card approves the balance transfer, that company contacts your creditor where the balance currently resides and pays them the amount you indicated on your application.

It usually happens quickly, but can take weeks for the payment to process. Continue to make any credit card payments if you have a payment due before your balance transfer is scheduled to go through so you avoid any late payment fees. Things to Consider about Balance Transfer Cards In order to make a credit card balance transfer work in your favor, it's important to understand a few things about how they work.

Make Sure to Pay on Time Most balance transfer credit cards will terminate the reduced APR if you pay late or miss a payment. Try to Keep from Racking up Additional Debt Most people open balance transfer credit cards in order to reduce their debt with a lower, more manageable interest rate.

Think Twice before Closing Your Credit Card You may be tempted to close the paid-off credit card in order to eliminate the temptation to use it. Applying for Balance Transfer Credit Cards Depending on your credit scores and the information on your credit report, you may or may not qualify for the optimum balance transfer offer available.

Balance Transfer Card Alternatives A balance transfer credit card can be an effective way to reduce debt and simplify payments, but it's not the only option available to you. Rather than open a new credit account, you could consider: Debt consolidation : This involves bundling multiple unsecured debts like credit cards into a single, lower-interest loan.

Having one payment per month can make it easier to keep up with payments and reduce the total amount of interest you pay. Credit counseling : A reputable, not-for-profit credit counselor can help you create a plan for paying off debt, and help you learn good credit habits to avoid accumulating new debt.

Debt management plan : When you consult with a credit counselor, he or she may advise you to go on a debt management plan. The goal of the plan is to pay off unsecured debt; mortgages, auto loans and student debt won't be included. Also, you'll have to close all your credit cards and agree not to apply for any new credit while on the plan.

Best Balance Transfer Cards Need to consolidate debt and save on interest? See Your Offers. Latest Research. Latest Reviews. Start Now Start Now for Free. You are able to pay off your balance before any promotional rate ends and rates increase.

Best balance transfer credit cards of February ; Wells Fargo Reflect® Card · Citi Simplicity® Card · U.S. Bank Visa® Platinum Card Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of